Whenever I digest a piece of information that seems super helpful, to not repeat the mistakes of my past, I try to implement it as soon as possible. As 2023 began, I read that it is a good idea to evaluate your finances periodically, at least once a year. They also recommended using the start of a new year as a great opportunity to reevaluate your budget. This helps you keep track of expenses, making sure the ever increasing price of things doesn't surprise you.

Having done a rough budget in order to get my Credit Card paid off on time, I don’t necessarily need to budget but I want to build good habits so lets start this yearly re-budgeting thing!

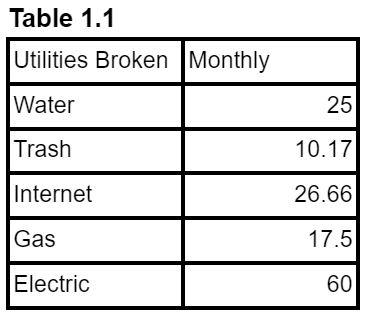

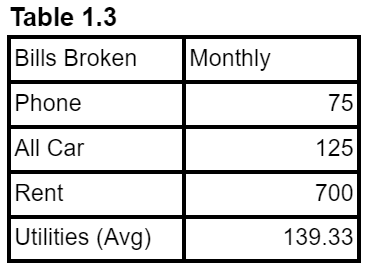

First, I need to break out the categories of bills - phone, car, rent, utilities. Rent and phone bills are a single payment each, easy to budget. Utilities and car expenses are not so easy, having a few different payments each. After tallying up all my utility payments (Table 1.1) and car expenses (Table 1.2), I can then add those to my phone and rent payments (Table 1.3). Now I know how much I need to spend each month to survive (minus food).

Next, I need to figure out how much cash I can spend each month on food and other things. I get paid weekly so I take my weekly check amount, multiply that by 52 and divide by 12 to get my monthly take home income. I add up all of my bills listed out above, subtract the two totals and voila there is my remaining monthly income after bills. I’d rather budget on a weekly basis so multiply by 12 and divide by 52 gives me my weekly budget.

Lastly, I subtract out my savings goal and I’m left with my cash remaining each week (Table 2) to spend on food and other things.

When budgeting I use estimates, averages, and I don’t try to be super precise. Some months bills are smaller, some months bills are larger. Some months I’ll work less, some months I’ll work more. By trying to be as precise as possible, I’d constantly be re-budgeting which in my opinion is a waste of time. By using estimates and averages, I can get a good understanding of what I should spend each week. Then, by constantly striving to spend less than that I can insulate myself from the inconsistencies life brings.